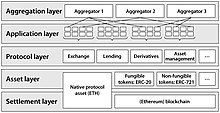

Decentralized finance (often stylized as DeFi) offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a blockchain, mainly Ethereum. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts.[1] DeFi uses a layered architecture and highly composable building blocks.[2] Some applications promote high-interest rates[1] but are subject to high risk.[3] Coding errors and hacks have been common in DeFi.[4][1]

History

[edit]

Decentralized exchanges (abbreviated DEXs) are alternative payment ecosystems with new protocols for financial transactions that emerged within the framework of decentralized finance,[2] which is part of blockchain technology and fintech.[5]

CEXs (centralized exchanges), DEXs and DEX aggregators are all built on the multi-layered DeFi architecture or components, where each layer serves a well-defined purpose.[2] (See Figure: Multi-layered Architecture of the DeFi Stack).

While they share common components of the first four layers, such as the Settlement layer, Asset layer, Protocol layer and Application layer, DEX aggregators have an additional component or Aggregator layer, which allows them to connect and interact with other DEXs via smart contracts.

The Ethereum blockchain popularized smart contracts, which are the basis of DeFi, in 2017. Other blockchains have since implemented smart contracts.

MakerDAO is a prominent lending DeFi platform based on a stablecoin that was established in 2017.[6][7] It allows users to borrow DAI, a token pegged to the US dollar. Through a set of smart contracts that govern the loan, repayment, and liquidation processes, MakerDAO aims to maintain the stable value of DAI in a decentralized and autonomous manner.[8][9]

In June 2020, Compound Finance, a decentralized finance protocol enabling users to lend or borrow cryptocurrency assets and which provides typical interest payments to lenders, started rewarding lenders and borrowers with a cryptocurrency called Comp. This token, which is used for running Compound, can also be traded on cryptocurrency exchanges. Other platforms followed suit, leading to stacked investment opportunities known as "yield farming" or "liquidity mining", where speculators shift cryptocurrency assets between pools in a platform and between platforms to maximize their total yield, which includes not only interest and fees but also the value of additional tokens received as rewards.[10]

In July 2020, The Washington Post described decentralized finance techniques and the risks involved.[10] In September 2020, Bloomberg said that DeFi made up two-thirds of the cryptocurrency market in terms of price changes and that DeFi collateral levels had reached $9 billion.[11] Ethereum saw a rise in developers during 2020 due to the increased interest in DeFi.[12]

DeFi has attracted venture capitalists such as Andreessen Horowitz[3] and Michael Novogratz.[13]

The Economist regarded the future of digital finance in 2022 as a "three-way fight" between: Big Tech, such as Facebook with its digital wallet; "big rich countries" that have been testing their own digital currencies; and software developers "building all sorts of applications" to decentralize finance. Handling the risks presented by crypto-assets already valued at $2.5 trillion was a particular challenge for US regulators.[14]

Key characteristics

[edit]DeFi revolves around decentralized applications, also known as DApps, that perform financial functions on distributed ledgers called blockchains, a technology that was made popular by Bitcoin and has since been adapted more broadly.[15][1] Rather than transactions being made through a centralized intermediary such as a cryptocurrency exchange or a traditional securities exchange, transactions are directly made between participants, mediated by smart contract programs.[3] These smart contracts, or DeFi protocols, typically run using open-source software that is built and maintained by a community of developers.[16]

DApps are typically accessed through a browser extension or application. For example, MetaMask allows users to directly interact with Ethereum through a digital wallet.[17][18] Many of these DApps can be linked to create complex financial services.[1] For example, stablecoin holders can lend assets such as USD Coin or DAI to a liquidity pool in a borrow/lending protocol such as Aave Protocol, and allow others to borrow those digital assets by depositing their own collateral.[19] The protocol automatically adjusts interest rates based on the demand for the asset.[3] Some DApps source external (off-chain) data, such as the price of an asset, through blockchain oracles.[20]

Additionally, Aave Protocol introduced "flash loans", which are uncollateralized loans of an arbitrary amount that are taken out and paid back within a single blockchain transaction.[21] Many exploits of DeFi platforms have used flash loans to manipulate cryptocurrency spot prices.[22]

Another DeFi protocol is Uniswap, which is a decentralized exchange (DEX) set up to trade tokens issued on Ethereum. Rather than using a centralized exchange to fill orders, Uniswap pays users to form liquidity pools in exchange for a percentage of the fees collected from traders swapping tokens in and out of the liquidity pools. Because no centralized party runs Uniswap (the platform is governed by its users), and any development team can use the open-source software, there is no entity to check the identities of the people using the platform and meet KYC/AML regulations. As of 2020, it is not clear what position regulators will take on the legality of such platforms.[23]

Decentralized exchanges

[edit]Decentralized exchanges (DEX) are a type of cryptocurrency exchange, which allow for either direct peer-to-peer, or Automated Market Maker (AMM) liquidity pool cryptocurrency transactions to take place without the need for an intermediary. The lack of an intermediary differentiates them from centralized exchanges (CEX).[citation needed]

In transactions made through decentralized exchanges, the typical third party entities which would normally oversee the security and transfer of assets (e.g. banks, stockbrokers, online payment gateways, government institutions, etc.) are substituted by a blockchain or distributed ledger. Some common methods of operation include the use of smart contracts or order book relaying – although many other variations are possible, with differing degrees of decentralization.[24][25]

Because traders on a decentralized exchange often do not need to transfer their assets to the exchange before executing a trade, decentralized exchanges reduce the risk of theft from hacking of exchanges,[26] but liquidity providers do need to transfer tokens to the decentralized exchange. Decentralized exchanges are also more anonymous than exchanges that implement know your customer (KYC) requirements.[27][28]

There are some signs that decentralized exchanges have been suffering from low trading volumes and reduced market liquidity.[29] The 0x project, a protocol for building decentralized exchanges with interchangeable liquidity, attempts to solve this issue.[30]

Disadvantages

[edit]Due to a lack of KYC processes, and no way to revert a transaction, users are at a loss if they are ever hacked for their passwords or private keys.[31] Additionally, liquidity providers staking in DeFi protocols can suffer what is called an impermanent loss if, when withdrawn, the token pairs they have invested have altered in value ratio significantly.[32][33][34]

Although liquidity pool DEX are the most widely used, they may have some drawbacks. The most common problems of liquidity pool DEXes are market price impact, slippage, and front running.

Price impact occurs because of the AMM (Automated Market Makers) nature itself — the larger the deal, the stronger impact it has on the price. For example, if the constant product AMM is in use, every deal must keep the product xy = k constant, where x and y are quantities of two cryptocurrencies (or tokens) in the pool. Price impact is non-linear, so the larger is the input amount Δx, the lower is the final ratio y / x that gives an exchange price. The problem is mostly significant for relatively large deals versus the liquidity pool size.[35][better source needed]

Front running is a special type of attack in public blockchains when some participant (usually a miner) seeing an upcoming trading transaction puts his own transaction ahead (playing with a transaction fee for example), making the initial transaction less profitable or even reverted. To provide some protection against front running attacks, many DeFi exchanges offer a slippage tolerance option for end-users. This option serves as a safeguard, allowing users to set a limit on the worst acceptable price they are willing to accept from the time of transaction signing.[citation needed]

Degrees of decentralization

[edit]A decentralized exchange can still have centralized components, whereby some control of the exchange is still in the hands of a central authority. The governance of a DeFi platform, typically as part of a Decentralized Autonomous Organization, is done through tokens that grant voting rights and are distributed amongst participants. However, the majority of these tokens are often held by few individuals and are rarely used to vote.[36]

In July 2018, the decentralized exchange Bancor was reportedly hacked and suffered a loss of $13.5M in assets before freezing funds.[37] In a Tweet, Charlie Lee, the creator of Litecoin spoke out and claimed an exchange cannot be decentralized if it can lose or freeze customer funds.[38]

Operators of decentralized exchanges can face legal consequences from government regulators. One example is the founder of EtherDelta, who in November 2018 settled charges with the U.S. Securities and Exchange Commission over operating an unregistered securities exchange.[39]

Errors and hacking

[edit]Coding errors and hacks are common in DeFi.[4][1] Blockchain transactions are irreversible, which means that an incorrect or fraudulent DeFi transaction cannot be corrected easily.

The person or entity behind a DeFi protocol may be unknown and may disappear with investors' money.[16] Investor Michael Novogratz has described some DeFi protocols as "Ponzi-like".[13]

DeFi has been compared to the initial coin offering craze of 2017, part of a cryptocurrency bubble. Inexperienced investors are at particular risk of losing money because of the sophistication required to interact with DeFi platforms and the lack of any intermediary with customer support.[4][40] On the other hand, as the code for DeFi smart contracts is generally open-source software that can be copied to set up competing platforms, experienced users and user-created bots might create instabilities as funds shift between platforms which share the same code.[16] In addition, DeFi platforms might inadvertently provide incentives for cryptocurrency miners to destabilize the system.[41]

In 2021, half of cryptocurrency crime was related to DeFi. This rise has been attributed to a combination of developer incompetence and non-existent or poorly enforced regulations.[42][43][44] Theft from DeFi can come from either external hackers stealing from vulnerable projects, or "rug pulls",[45] where the developers and influencers promote a project and then take the money, as a form of pump-and-dump.[44]

Regulation

[edit]In October 2021, the FATF included DeFi in the guidance for crypto service providers, making the authority's aim to regulate this type of asset.[46][47] They are expecting each individual country to determine if individuals involved in DeFi can be considered a virtual asset provider and be subjected to the FATF's guidelines.[48]

See also

[edit]References

[edit]- ^ a b c d e f "Why 'DeFi' Utopia Would Be Finance Without Financiers: QuickTake". Bloomberg. 26 August 2020. Archived from the original on 15 October 2020. Retrieved 6 October 2020.

- ^ a b c Schär, Fabian (2021). "Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets" (PDF). Review. 103 (2). doi:10.20955/r.103.153-74. S2CID 234896331.

- ^ a b c d "'DeFi' movement promises high interest but high risk". Financial Times. 30 December 2019. Archived from the original on 21 May 2021. Retrieved 6 October 2020.

- ^ a b c "Boom or bust? Welcome to the freewheeling world of crypto lending". Reuters. 26 August 2020. Archived from the original on 29 September 2020. Retrieved 6 October 2020.

- ^ Zetzsche, Dirk A.; Arner, Douglas W.; Buckley, Ross P. (September 2020). "Decentralized Finance". Journal of Financial Regulation. 6 (20): 172–303. doi:10.1093/jfr/fjaa010. Archived from the original on 3 December 2021. Retrieved 25 February 2022.

- ^ "The Maker Protocol: MakerDAO's Multi-Collateral Dai (MCD) System". MakerDAO. Archived from the original on 24 June 2021. Retrieved 18 June 2021.

- ^ S. Bhat, A. Kahya, R. Kumar and B. Krishnamachari (2021) "Simulating the MakerDAO stablecoin", IEEE International Conference on Blockchain and Cryptocurrency, pp. 1-2. https://anrg.usc.edu/www/papers/makerdao.pdf Archived 1 January 2022 at the Wayback Machine

- ^ "Why 'DeFi' Utopia Would Be Finance Without Financiers: QuickTake". Bloomberg.com. 26 August 2020. Archived from the original on 15 October 2020. Retrieved 26 January 2021.

- ^ Stabile, Daniel T.; Prior, Kimberly A.; Hinkes, Andrew M. (31 July 2020). Digital Assets and Blockchain Technology: US Law and Regulation. Edward Elgar Publishing. ISBN 978-1-78990-744-5.

- ^ a b "What's 'Yield Farming'? (And How Do You Grow Crypto?)". The Washington Post. 31 July 2020. Archived from the original on 11 October 2023. Retrieved 5 October 2020.

- ^ "Crypto Is Beating Gold as 2020's Top Asset So Far". Bloomberg. 22 September 2020. Archived from the original on 3 October 2020. Retrieved 5 October 2020.

- ^ "Coders Flock Back to Crypto Projects With Prices Surging Again". Bloomberg.com. 10 December 2020. Archived from the original on 19 April 2022. Retrieved 28 December 2020.

- ^ a b "Novogratz Plows Ahead In DeFi Amid the 'Gamifying' of Crypto". Bloomberg. 29 September 2020. Archived from the original on 9 January 2021. Retrieved 6 October 2020.

- ^ Rachana Shanbhogue (2021) "A three-way fight to shape the future of digital finance has begun Archived 14 January 2022 at the Wayback Machine", The Economist: The World Ahead 2022, 8 November. Accessed 6 January 2022

- ^ Decentralized Finance (DeFi): An Emergent Alternative Financial Architecture. Archived 20 April 2021 at the Wayback Machine Regulation of Financial Institutions eJournal. Social Science Research Network (SSRN). Accessed 20 April 2021.

- ^ a b c "Crypto Exchange Gets Millions After Copy-Paste of a Rival's Code". Bloomberg. 11 September 2020. Archived from the original on 24 February 2021. Retrieved 6 October 2020.

- ^ Schroeder, Stan (2 September 2020). "Crypto wallet MetaMask finally launches on iOS and Android, and it supports Apple Pay". Mashable. Archived from the original on 2 September 2020. Retrieved 15 December 2020.

- ^ "MetaMask's Blockchain Mobile App Opens Doors For Next-Level Web". Bloomberg.com. 2 September 2020. Archived from the original on 12 May 2022. Retrieved 12 December 2020.

- ^ Wilson, Tom (26 August 2020). "Boom or bust? Welcome to the freewheeling world of crypto lending". Reuters. Archived from the original on 17 April 2021. Retrieved 8 April 2021.

- ^ Orcutt, Mike. "Blockchain smart contracts are finally good for something in the real world". MIT Technology Review. Archived from the original on 18 May 2022. Retrieved 24 November 2021.

- ^ "Flash Loans Are Providing Instant Cash to Crypto Speculators". Bloomberg.com. 7 February 2021. Archived from the original on 21 February 2021. Retrieved 8 April 2021.

- ^ Evans, Jon (18 February 2020). "DeFiance: billion dollar finance, million dollar hacks, and very little value". TechCrunch. Archived from the original on 1 December 2020. Retrieved 22 November 2020.

- ^ Kharif, Olga (16 October 2020). "DeFi Boom Makes Uniswap Most Sought-After Crypto Exchange". Bloomberg.com. Bloomberg. Archived from the original on 3 December 2021. Retrieved 7 November 2020.

- ^ Wong, Joon Ian (30 May 2018). "Coinbase bought a "decentralized" crypto exchange. How does that work?". Quartz. Archived from the original on 3 July 2019. Retrieved 3 December 2020.

- ^ "This 31-Year-Old Is Trying to Revolutionize Cryptocurrency Trading". Bloomberg.com. 28 September 2017. Archived from the original on 9 November 2019. Retrieved 3 December 2020.

- ^ Castellanos, Sara (6 March 2018). "Alexis Ohanian's VC Firm Invests in Crypto Trading Platform". Wall Street Journal. ISSN 0099-9660. Archived from the original on 9 November 2020. Retrieved 11 September 2018.

- ^ Sigalos, MacKenzie (30 November 2022). "Bitcoin Family is moving more than $1 million into decentralized exchanges after Sam Bankman-Fried's FTX disaster". CNBC. Archived from the original on 25 August 2023. Retrieved 25 August 2023.

- ^ Calcaterra, Craig; Kaal, Wulf (2021). Decentralization: Technology's Impact on Organizational and Societal Structure. De Gruyter. ISBN 978-3-11-067403-3. Archived from the original on 25 August 2023. Retrieved 25 August 2023.

- ^ Russolillo, Steven; Jeong, Eun-Young (16 July 2018). "Cryptocurrency Exchanges Are Getting Hacked Because It's Easy". Wall Street Journal. ISSN 0099-9660. Archived from the original on 11 September 2018. Retrieved 11 September 2018.

- ^ "0x lets any app be the Craigslist of cryptocurrency". TechCrunch. Archived from the original on 21 October 2020. Retrieved 24 November 2018.

- ^ "Bloomberg - Record Crypto Heist Raises the Appeal of a New Type of Exchange". Bloomberg. 30 January 2018. Archived from the original on 30 January 2018. Retrieved 17 November 2018.

- ^ Lewis, Rhian (2023). Understanding Decentralized Finance: How DeFi Is Changing the Future of Money. Kogan Page. p. 76. ISBN 978-1-3986-0938-9. Archived from the original on 24 August 2023. Retrieved 24 August 2023.

- ^ Ma, Winston; Huang, Ken (2022). Blockchain and Web3: Building the Cryptocurrency, Privacy, and Security Foundations of the Metaverse. John Wiley & Sons. ISBN 978-1-119-89110-9. Archived from the original on 24 August 2023. Retrieved 24 August 2023.

- ^ Arslanian, Henri (2022). The Book of Crypto: The Complete Guide to Understanding Bitcoin, Cryptocurrencies and Digital Assets. Springer Nature. pp. 306–307. ISBN 978-3-030-97951-5. Archived from the original on 24 August 2023. Retrieved 24 August 2023.

- ^ Jensen, Johannes Rude; Pourpouneh, Mohsen; Nielsen, Kurt; Ross, Omri (2021). "The Homogeneous Properties of Automated Market Makers". arXiv:2105.02782 [q-fin.TR].

- ^ Barbereau, Tom; Smethurst, Reilly; Papageorgiou, Orestis; Sedlmeir, Johannes; Fridgen, Gilbert (May 2023). "Decentralised Finance's timocratic governance: The distribution and exercise of tokenised voting rights". Technology in Society. 73: 102251. doi:10.1016/j.techsoc.2023.102251. S2CID 258245920.

- ^ Osborne, Charlie. "Another hack rocks cryptocurrency trading: Bancor loses $13.5 million". ZDNet. Archived from the original on 28 April 2019. Retrieved 13 December 2018.

- ^ "The crypto world's latest hack sees Bancor lose $23.5M". TechCrunch. 10 July 2018. Archived from the original on 10 July 2018. Retrieved 13 December 2018.

- ^ "SEC, EtherDelta founder settle charges over operating unregistered exchange". Reuters. Archived from the original on 8 November 2018. Retrieved 5 June 2018.

- ^ Braun, Alexander; Cohen, Lauren H.; Xu, Jiahua (May 2020). "fidentiaX: The Tradable Insurance Marketplace on Blockchain". Harvard Business School. Archived from the original on 27 January 2021. Retrieved 5 January 2021.

- ^ Yaish, Aviv; Tochner, Saar; Zohar, Aviv (12 July 2022). "Blockchain Stretching & Squeezing: Manipulating Time for Your Best Interest". Proceedings of the 23rd ACM Conference on Economics and Computation. EC '22. New York, NY, USA: Association for Computing Machinery. pp. 65–88. doi:10.1145/3490486.3538250. ISBN 978-1-4503-9150-4. S2CID 250497046.

- ^ Chavez-Dreyfuss, Gertrude (14 May 2021). "Cryptocurrency Crime Declines But 'DeFi' Fraud Soars: CipherTrace". Insurance Journal. Reuters. Archived from the original on 28 October 2021. Retrieved 28 October 2021.

- ^ Davis, Griffin (14 October 2021). "DeFi, Crypto Expansion Puts US at Risk of More Ransomware Attacks?". Tech Times. Archived from the original on 28 October 2021. Retrieved 28 October 2021.

- ^ a b Combs, Veronica (24 August 2021). "Don't get rugged: DeFi scams go from zero to $129 million in a year to become top financial hack". TechRepublic. Archived from the original on 27 August 2021. Retrieved 7 May 2023.

- ^ Cernera, F.; La Morgia, M.; Mei, A.; Sassi, F. (August 2023). "Token Spammers, Rug Pulls, and Sniper Bots: An Analysis of the Ecosystem of Tokens in Ethereum and in the Binance Smart Chain (BNB)" (PDF). 32nd USENIX Security Symposium (USENIX Security 23). Archived (PDF) from the original on 11 October 2023. Retrieved 12 September 2023.

- ^ "Updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers". FATF. 28 October 2021. Archived from the original on 31 January 2023. Retrieved 28 February 2023.

- ^ Barbereau, Tom; Bodó, Balázs (1 July 2023). "Beyond financial regulation of crypto-asset wallet software: In search of secondary liability". Computer Law & Security Review. 49: 105829. doi:10.1016/j.clsr.2023.105829. ISSN 0267-3649. S2CID 258733922.

- ^ "VASPs (Virtual Asset Service Providers): What are they? | Notabene". notabene.id. Archived from the original on 19 July 2022. Retrieved 24 August 2022.

| Technology | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consensus mechanisms | |||||||||||||||

| Proof of work currencies |

| ||||||||||||||

| Proof of stake currencies | |||||||||||||||

| ERC-20 tokens | |||||||||||||||

| Stablecoins | |||||||||||||||

| Other currencies | |||||||||||||||

| Inactive currencies | |||||||||||||||

| Cryptocurrency exchanges |

| ||||||||||||||

| Crypto service companies | |||||||||||||||

| Related topics |

| ||||||||||||||