Securities and Exchange Board of India | |

SEBI Bhavan, Mumbai | |

| Agency overview | |

|---|---|

| Formed | April 12, 1988 (Established) January 30, 1992 (Acquired Statutory Status)[1] |

| Type | Regulatory agency |

| Headquarters | Mumbai, Maharashtra |

| Employees | 867+ (2020)[2] |

| Agency executive | |

| Parent department | Ministry of Finance, Government of India |

| Child agencies | |

| Key document |

|

| Website | sebi |

| Footnotes | |

| [4] | |

| Categories of |

| Financial risk |

|---|

| Credit risk |

| Market risk |

| Liquidity risk |

| Investment risk |

| Business risk |

| Profit risk |

| Non-financial risk |

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992.[1][5]

History

[edit]The Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. Before it came into existence, the Controller of Capital Issues was the market's regulatory authority, and derived power from the Capital Issues (Control) Act, 1947.[6] SEBI became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act, 1992 by the Parliament of India.[7] It has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad, respectively. Up until June 2023, it also had 17 local offices spread all over India to promote investor education; however, 16 of them were closed as part of a restructuring exercise.[8][9]

SEBI is managed by its board of members, which consist of the following people:

- The chairman, who is nominated by the Union Government of India.

- Two members from the Union Finance Ministry.

- One member from the Reserve Bank of India.

- The remaining five members are nominated by the Union Government of India, and out of them at least three should be whole-time members.

After the amendment of 1999, collective investment schemes were brought under SEBI except nidhis, chit funds and cooperatives.

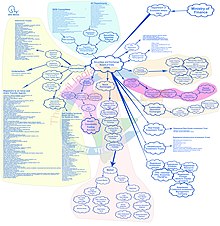

Organisation structure

[edit]

Madhabi Puri Buch took charge of chairman on 1 March 2022, replacing Ajay Tyagi, whose term ended on 28 February 2022. Madhabi Puri Buch is the first woman chairperson of SEBI.[10][11]

Current Board members

[edit]| Name | Designation |

|---|---|

| Madhabi Puri Buch | Chairperson |

| S.K Mohanty | Whole time member |

| Ananth Narayan G | Whole time member |

| Ashwini Bhatia | Whole time member |

| Kamlesh Chandra Varshney | Whole time member |

| Ajay Seth | Part-time member |

| Rajesh Verma | Part-time member |

| M. Rajeshwar Rao | Part-time member |

| V Ravi Anshuman | Part-time member |

List of Chairpersons

[edit]List of Chairmen:[14]

| Name | From | To |

|---|---|---|

| Madhabi Puri Buch | 1 March 2022 | Present |

| Ajay Tyagi | 10 February 2017 | 28 February 2022 |

| U K Sinha | 18 February 2011 | 10 February 2017 |

| C. B. Bhave | 18 February 2008 | 18 February 2011 |

| M. Damodaran | 18 February 2005 | 18 February 2008 |

| G. N. Bajpai | 20 February 2002 | 18 February 2005 |

| D. R. Mehta | 21 February 1995 | 20 February 2002 |

| S. S. Nadkarni | 17 January 1994 | 31 January 1995 |

| G. V. Ramakrishna | 24 August 1990 | 17 January 1994 |

| Dr. S. A. Dave | 12 April 1988 | 23 August 1990 |

National Apex Bodies

[edit]Functions and responsibilities

[edit]The Preamble of the Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as "...to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected there with or incidental there to".

SEBI has to be responsive to the needs of three groups, which constitute the market:

- issuers of securities

- investors

- market intermediaries

SEBI has three powers rolled into one body: quasi-legislative, quasi-judicial and quasi-executive. It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity. Though this makes it very powerful, there is an appeal process to create accountability. There is a Securities Appellate Tribunal which is a three-member tribunal and is currently headed by Justice Tarun Agarwala, former Chief Justice of the Meghalaya High Court.[15] A second appeal lies directly to the Supreme Court. SEBI has taken a very proactive role in streamlining disclosure requirements to international standards.[16]

Powers

[edit]For the discharge of its functions efficiently, SEBI has been vested with the following powers:

- to approve by−laws of Securities exchanges.

- to require the Securities exchange to amend their by−laws.

- inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- inspect the books of accounts of financial intermediaries.

- compel certain companies to list their shares in one or more Securities exchanges.

- registration of Brokers and sub-brokers.

- eliminate malpractices in security market.

SEBI committees

- Technical Advisory Committee

- Committee for review of structure of infrastructure institutions

- Advisory Committee for the SEBI Investor Protection and Education Fund

- Takeover Regulations Advisory Committee

- Primary Market Advisory Committee (PMAC)

- Secondary Market Advisory Committee (SMAC)

- Mutual Fund Advisory Committee

- Corporate Bonds & Securitisation Advisory Committee

There are two types of brokers:

- Discount brokers

- Merchant brokers

Major achievements

[edit]SEBI has enjoyed success as a regulator by pushing systematic reforms aggressively and successively. It is credited for quick movement towards making the markets electronic and paperless by introducing the T+5 rolling cycle in July 2001, the T+3 in April 2002, and the T+2 in April 2003. The rolling cycle of T+2 means that settlement is done in 2 days after trade date.[17][18] SEBI has also been active in setting up the regulations as required under law. It did away with physical certificates that were prone to postal delays, theft and forgery, apart from making the settlement process slow and cumbersome, by passing the Depositories Act, 1996.[19][20]

SEBI has also been instrumental in taking quick and effective steps in light of the global meltdown and the Satyam fiasco.[citation needed] In October 2011, it increased the extent and quantity of disclosures to be made by Indian corporate promoters.[21] In light of the global meltdown, it liberalized the takeover code to facilitate investments by removing regulatory structures. In one such move, SEBI has increased the application limit for retail investors to ₹200,000 (US$2,400) from ₹100,000 (US$1,200) at present.[22]

On the occasion of World Investor Week 2022, SEBI Executive Director Shri G. P. Garg launched a book on Financial Literacy. This book is a joint effort between Metropolitan Stock Exchange of India Limited and CASI New York.[23][24]

Criticism and controversies

[edit]Supreme Court of India heard a Public Interest Litigation (PIL) filed by India Rejuvenation Initiative that had challenged the procedure for key appointments adopted by Govt of India. The petition alleged that, "The constitution of the search-cum-selection committee for recommending the name of chairman and every whole-time members of SEBI for appointment has been altered, which directly impacted its balance and could compromise the role of the SEBI as a watchdog."[25][26] On 21 November 2011, the court allowed petitioners to withdraw the petition and file a fresh petition pointing out constitutional issues regarding appointments of regulators and their independence. The Chief Justice of India refused the finance ministry's request to dismiss the PIL and said that the court was well aware of what was going on in SEBI.[25][27] Hearing a similar petition filed by Bengaluru-based advocate Anil Kumar Agarwal, a two judge Supreme Court bench of Justice Surinder Singh Nijjar and Justice HL Gokhale issued a notice to the Govt of India, SEBI chief UK Sinha and Omita Paul, Secretary to the President of India.[28][29]

Further, it came into light that Dr. K. M. Abraham(the then whole time member of SEBI Board) had written to the Prime Minister about malaise in SEBI. He said, "The regulatory institution is under duress and under severe attack from powerful corporate interests operating concertedly to undermine SEBI". He specifically said that Finance Minister's office, and especially his advisor Omita Paul, were trying to influence many cases before SEBI, including those relating to Sahara Group, Reliance, Bank of Rajasthan and MCX.[30][31]

Regulatory failure, inaction, and incompetence

[edit]Several major financial scams have shaken the Indian market, like the Satyam scam, IL&FS crisis, Punjab National Bank Scam, and NSE co-location scam Critics argue that SEBI failed to properly monitor these companies or take timely action when irregularities were noticed.[32][33] There have been instances where market intermediaries engaged in fraudulent activities, which resulted in significant losses for investors.[33][34] SEBI’s monitoring of these intermediaries has been called into question. SEBI has been criticized for its inability to effectively regulate and prevent insider trading, despite having regulations in place. There have been numerous cases where insider trading went undetected for long periods.[33] Some believe SEBI hasn't done enough to prevent companies from issuing IPOs (Initial Public Offerings) at inflated prices, which hurts regular investors.[35][36]

Market manipulation is an ongoing concern in the Indian stock market, particularly with small-cap and mid-cap stocks, which are more susceptible due to lower trading volumes, less liquidity, and limited market analyst coverage. Pump and dump schemes are a prevalent form of manipulation, where false or misleading statements are used to inflate a stock’s price before the manipulators sell off their shares at a profit, leading to significant losses for unsuspecting investors.[37][38][39]

The Securities and Exchange Board of India (SEBI) has been criticized for not being able to prevent such manipulations effectively. Reasons include limited resources, reliance on stock exchanges for market data, a lack of a comprehensive legal framework with stringent penalties, slow response times, and a lack of coordination with other regulatory bodies.[40][41]

Regional Securities exchanges

[edit]SEBI in its circular dated 30 May 2012 gave exit – guidelines for Securities exchanges. This was mainly due to illiquid nature of trade on many of 20+ regional Securities exchanges. It had asked many of these exchanges to either meet the required criteria or take a graceful exit. SEBI's new norms for Securities exchanges mandates that it should have minimum net-worth of ₹ 1 billion and an annual trading of ₹ 10 billion. The Indian Securities market regulator SEBI had given the recognized Securities exchanges two years to comply or exit the business.[42]

SEBI is cracking down on virtual stock gaming apps popular among retail investors for creating virtual portfolios and competing on real-time stock prices.[43]

Process of de-recognition and exit

[edit]Following is an excerpt from the circular:[44]

- Exchanges may seek exit through voluntary surrender of recognition.

- Securities where the annual trading turnover on its own platform is less than ₹ 10 billion can apply to SEBI for voluntary surrender of recognition and exit, at any time before the expiry of two years from the date of issuance of this Circular.

- If the Securities exchange is not able to achieve the prescribed turnover of ₹ 10 billion on continuous basis or does not apply for voluntary surrender of recognition and exit before the expiry of two years from the date of this Circular, SEBI shall proceed with compulsory de-recognition and exit of such Securities exchanges, in terms of the conditions as may be specified by SEBI.

- Securities Exchanges which are already de-recognised as on date, shall make an application for exit within two months from the date of this circular. Upon failure to do so, the de-recognised exchange shall be subject to compulsory exit process.

Departments

[edit]SEBI regulates Indian financial market through its 20 departments.[45]

| SEBI Departments |

|

See also

[edit]- U.S. Securities and Exchange Commission

- Commodity Futures Trading Commission

- Financial Conduct Authority

- Federal Financial Supervisory Authority

- 1992 Indian stock market scam

- Ketan Parekh

- Accounting scandals

- Dot-com bubble

- Financial crisis of 2007–2008

- Financial regulation

- Financial risk management

- Forward Markets Commission

- Insider trading

- Institute of Chartered Accountants of India

- Institute of Company Secretaries of India

- List of financial regulatory authorities by jurisdiction

- List of stock exchanges in the Commonwealth of Nations

- Market manipulation

- Regulation D (SEC)

- Risk management

- Satyam scandal

- Securities commission

- Securities exchange

References

[edit]- ^ a b "About SEBI". SEBI. Archived from the original on 3 October 2010. Retrieved 26 September 2012.

- ^ "SEBI | Employee Profile in SEBI".

- ^ Securities and Exchange Board of India Act, 1992 (PDF) (15). Parliament of India. 1992.

- ^ SEBI (28 June 2023). Annual Report, 2022-23 (Report). Retrieved 6 January 2024.

- ^ "The Security and Exchange Board of India Act 1992" (PDF). www.sebi.gov.in. SEBI. Retrieved 25 July 2022.

- ^ The Capital Issues (Control) Act, 1947 (PDF) (29). Parliament of India. 1947.

- ^ "What is SEBI?". business-standard.com. Business Standard. Retrieved 6 January 2024.

- ^ "Expanding Investor Reach through Investors' Service Centres (ISCs) in association with Stock Exchanges and disengaging SEBI Local Offices in a phased manner" (PDF). sebi.gov.in. SEBI. 28 June 2023. Retrieved 6 January 2024.

The objective of this memorandum is to (i) update the Board on the setting up and operationalising of Investors' Service Centres (ISCs) by the two leading Stock Exchanges, viz., NSE and BSE out of their own resources/Investor Service Fund (ISF), in 50 different cities and towns of India with SEBI's active association and participation in such ISCs and (ii) seek approval for phasing out 16 out of 17 Local Offices of SEBI in those cities. Four Regional Offices and one Local Office would continue to operate.

- ^ Zachariah, Reena (6 January 2024). "SEBI to close down 16 smaller offices". Economic Times. New Delhi. Retrieved 6 January 2024.

- ^ "Who is Madhabi Puri Buch, the first-ever woman to head SEBI?". Moneycontrol. 28 February 2022. Retrieved 17 November 2023.

- ^ PTI (28 February 2022). "Madhabi Puri Buch appointed first woman chairperson of SEBI". The Hindu. ISSN 0971-751X. Retrieved 17 November 2023.

- ^ "SEBI|Board Members" (PDF). Retrieved 28 February 2012.

- ^ "SEBI Board Members". Retrieved 18 April 2022.

- ^ "Former Chairmen of SEBI". SEBI. Retrieved 19 February 2011.

- ^ Justice Tarun Agarwala appointed Securities Appellate Tribunal presiding officer – Business Standard. Business Standard. (2018-12-12). Retrieved 2019-03-24.

- ^ "Cyril Shroff Managing Partner Mumbai & National Capital Market head Amarchand". barandbench.com/. 14 June 2010.

- ^ "Discussion Paper Implementation of T+2 rolling settlement" (PDF). SEBI. Retrieved 25 October 2012.

- ^ "Sebi gets rolling on T+2 settlement schedule". The Economic Times. 4 January 2003. Retrieved 25 October 2012.

- ^ Sebi's 25-year journey. Livemint (2013-05-21). Retrieved 2013-07-29.

- ^ "The Depositories Act, 1996" (PDF). indiacode.nic.in. Ministry of Law and Justice, Government of India. Retrieved 14 December 2023.

- ^ "Sebi doubles retail limit, tightens IPO norms". Rediff.com. Retrieved 27 October 2010.

- ^ "Book Launch on Financial Literacy – PNN Digital". 17 October 2022.

- ^ "Book Launch on Financial Literacy – Live Mumbai".

- ^ a b "Is Sebi's Autonomy Under Threat?". 15 November 2011. Retrieved 10 April 2012.

- ^ "PIL alleges nexus in Sebi appointments". 5 November 2011. Retrieved 10 April 2012.

- ^ "SC allows eminent citizens to withdraw petition against SEBI chief's appointment". 21 November 2011. Retrieved 10 April 2012.

- ^ "Notice to Centre on quo warranto against SEBI chief". The Hindu. 26 September 2012. Retrieved 26 September 2012.

- ^ "SC seeks Centre's reply on PIL on Sebi chairman's appointment". Deccan Herald. 26 September 2012. Retrieved 26 September 2012.

- ^ "KM Abraham's letter to PM". Prime Minister's Office. 20 October 2011. Retrieved 11 April 2012.

- ^ "Pranab-Chidu feud may be revived over Sebi chief PIL". 12 November 2011. Retrieved 11 April 2012.

- ^ Singh, V.K. (2021). Corporate Governance Failures as a Cause of Increasing Corporate Frauds in India—An Analysis. In: Kaur, H. (eds) Facets of Corporate Governance and Corporate Social Responsibility in India. Accounting, Finance, Sustainability, Governance & Fraud: Theory and Application. Springer, Singapore. doi:10.1007/978-981-33-4076-3_2

- ^ a b c Gupta, Rajeev. "Has SEBI completely failed in regulating the capital market in India?". The Times of India.

- ^ Sabarinathan, G. (2010). SEBI’s Regulation of the Indian Securities Market: A Critical Review of the Major Developments. Vikalpa, 35(4), 13-26. doi:10.1177/0256090920100402

- ^ "IPOs thrive despite election season: Companies plan to raise over Rs 10,000 crore in May". The Times of India. 2 May 2024.

- ^ "IPO count rises in 2023, but amount lags". The Times of India. 25 December 2023.

- ^ Uppal, Jamshed Y., and Inayat U. Mangla. “Market Volatility, Manipulation, and Regulatory Response: A Comparative Study of Bombay and Karachi Stock Markets.” The Pakistan Development Review, vol. 45, no. 4, 2006, pp. 1071–83. JSTOR 41260669. Accessed 30 May 2024.

- ^ Goel, A., Tripathi, V. and Agarwal, M. (2021), "Market microstructure: a comparative study of Bombay stock exchange and national stock exchange", Journal of Advances in Management Research, Vol. 18 No. 3, pp. 414-442. doi:10.1108/JAMR-06-2020-0109

- ^ https://www.researchgate.net/profile/Chakrapani-Chaturvedula/publication/311446941_The_Effectiveness_of_Trade_for_Trade_Segment_as_a_Surveillance_Effort_to_Prevent_Price_Manipulation_Evidence_from_India/links/58f7a2094585158d8a6c176e/The-Effectiveness-of-Trade-for-Trade-Segment-as-a-Surveillance-Effort-to-Prevent-Price-Manipulation-Evidence-from-India.pdf

- ^ Bose, Suchismita, Securities Market Regulations: Lessons from US and Indian Experience (2005). The ICRA Bulletin, Money & Finance, Vol. 2, No. 20-21, Jan-Jun 2005, Available at SSRN 1140107

- ^ Agarwalla, Sobhesh Kumar and Jacob, Joshy and Varma, Jayanth Rama, High Frequency Manipulation at Futures Expiry: The Case of Cash Settled Indian Single Stock Futures (February 10, 2014). Indian Institute of Management, Ahmedabad, India Working Paper No. 2014-02-01, Available at SSRN 2395159 or doi:10.2139/ssrn.2395159

- ^ Rukhaiyar, Ashish (20 May 2014). "15 regional Securities exchanges to shut operations as Sebi deadline approaches". livemint.com/. Retrieved 15 May 2017.

- ^ ""SEBI is banning apps that offer these virtual trading services"".

- ^ "笺憷︺汨俱 广沏洇慵泐沅︺ '沣趵 沅蹄沅躲姐俱 恒泷" (PDF). www.bseindia.com. Retrieved 15 May 2017.[dead link]

- ^ "SEBI Departments". 7 February 2018.

External links

[edit]Financial services in India | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||